Tech Recession of 2022?

Curious as to what you guys think of this.

Here are the stock declines:

Last 6 months:

Coinbase: Down 85%

Cloudflare: Down 72%

Palantir: Down 70%

Spotify: Down 65%

Snowflake: Down 65%

Okta: Down 65%

Netflix: Down 75%

Amazon: Down 40%

Meta: Down 40%

Google: Down 25%

Microsoft: Down 20%

It's not normal that even the largest tech companies dip this much. Netflix's 75% drop is especially frightening (and it's not like any other streaming service gained when Netflix lost. Disney is down 35%).

Meta has instituted a hiring freeze. Total comp at all the companies will be less than before, as a lot of compensation is done via stock. I feel like the software engineering market will see some layoffs and more hiring freezes. In the coming months, I think we'll see companies focus on net profit rather than growth.

Startups have it pretty hard as well, as money is a lot harder to come by. I'm currently working on raising some money, and I can tell you firsthand that it's much harder than before. It's about half of what I expected three months ago, even though the metrics are a lot better now.

I see a dot-com bubble starting that will ripple to other industries too.

What do you think?

Additional reading: https://www.nytimes.com/interactive/2022/04/19/technology/tech-startup-bubble.html

Comments

Definitely noticing a similar recession in the tech/stock part of my portfolio as well.

At this point, I am kinda glad that I also have a Commodity ETF (among those shown, I have the iShares Diversified Commodity Swap UCITS ETF ) in my portfolio, just like a Real Estate ETF (among those shown, I have the iShares Developed Markets Property Yield ETF) which kinda tend to go strong(er) when the rest is dipping.

Real Estate:

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

Hoping that it's just sticking to tech.

Really worried that this is the start of a wider crash

Was only a matter of time. Despite what wall street "experts" will say, even tech companies don't have infinite value and eventually stabilize to more realistic valuations. Similar vibes to the housing market crash 15 years ago.

Head Janitor @ LES • About • Rules • Support • Donate

Coinbase: price built on volatile crypto market which is in freefall

Cloudflare: missed analyst targets quite a bit

Palantir: losses, uncertain future

Spotify: slower than expected growth, probably harmed by Netflix growth stop

Snowflake aka Warren Buffets big mistake: overvalued, losses

Okta: Security breach + low earnings

Netflix: Subscriber growth has completely stopped

Amazon: slow revenue growth + sales decline from pandemic boom

Meta: Ad revenue is down and shift into metaverse isn't going well

Google: ad revenue issues

Microsoft: Sales have gone down from the pandemic boom

Generally due to inflation people will be backing of riskier long-term investments

I don't think this is gonna affect the entire tech sector, it's mainly gonna be the companies without immediate value

Regarding startups, from the two seed round startups know the founders of, I haven't been told of any increased difficulty in funding. VCs don't really care about the present economic situation that much

About bloody time valuations came to more reasonable P/E ratios .

And a recession is long overdue. Been what 13 years now? Cannot beat the economic cycles forever

VPS reviews and benchmarks |

The end is coming.

♻ Amitz day is October 21.

♻ Join Nigh sect by adopting my avatar. Let us spread the joys of the end.

I almost started investing in my kids' college fund last week. Yikes. Good thing Vanguard's sign up process sucks. I'm now thinking of buying in when the big ETFs are down 50% YoY or when the media starts hyping up the economy again.

Odds are that time in the market will beat timing the market when it comes to ETF (holding more than 10 years), anyway. That being said, the current situation is probably a good opportunity to grab some ETF shares for cheap

If you are looking to compare various ETF or look for guides etc, probably https://justetf.com is a good way to start

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

It's not just tech, we're in a bubble and it's about to pop. Think 2008. Have you look at the reported Inflation recently? and that's what is being reported...

Humanity will trigger World War 3 soon. This is not the best moment to invest in volatile money, such as cryptocurrencies. I don't think people will focus on blockchain and mining in times of crisis.

Stacksocial link (aff) containing a gift of $10 after your first purchase.

Best invest in properties right now. May be this is crucial moment. Yeah spanish real estate is a bubble right now but at least you would have something material to rent/sell. With luck you could buy something for 120K and rent it for 700 euros monthly. In 15years would be paid. Not bad.

Dentistry is my passion

You could always do half of that funds deposit now and half when you think the market is right. That way you’re still in incase the market doesn’t go the way you want it to.

Not financial advice, just the ramblings of an online stranger.

MichaelCee

Our studios been booming more than ever, but a lot of the old boy San Fran startup mentality companies are getting hit hard. Unity had an 80% drop as well.

I don't know what the cause is, but it's helpful to also note that public stock value != revenue or cash on hand, but is influenced by it. I dunno, we've worked with a lot of these companies, and they are mostly full of interns with little experience and grand ideas and slow or little follow through... So I'm not overly surprised.

Netflix is the outlier, they've been showing some signs of desperation for quite a while and dragging their feet and letting competitors catch up without any new innovation. So no surprises there as they've seen competitors building up for 10 years and been unable to do anything about it. Their last feature was to add a bunch of games that no one asked for or really wanted. But the last innovation they made was ... streaming movies.

I also wonder / imagine folx moving away from traditional stock and investment and more to crypto is part of this too. I suspect there is just a lot less stock investment across the board. I know most people these days see stocks as fixed and antiquated. I wonder if today's early business class has more faith in NFTs than Meta stock.

Some other tidbits: I've always been against taking investment and stock. But we have had several large serious investors reach out in the last month. And I sat in on a government call where they are building an innovation fund for investing that is entirely crypto. So I'm not sure it has changed investments here locally, and I do wonder if it's just an evolution of something bigger happening... But I'm also not really following the finance side of these companies.

XR Developer | https://redironlabs.com

Nice, congrats!

Yeah, if companies don't have high valuations to fundraise at, it'll be much harder to get the capital a company needs. For capex-intensive businesses (like infrastructure, especially GPUs which I work with), access to capital markets is just so important, whether it's equity fundraising at a high valuation to get a large amount of cash at low dilutions or low-interest debt. It's been a huge party for the last 5 years, and I think the music just stopped.

Now, the big-tech layoffs will happen as companies look to increase net profitability, starting with Twitter's hiring freeze and firing of 2 product leads today.

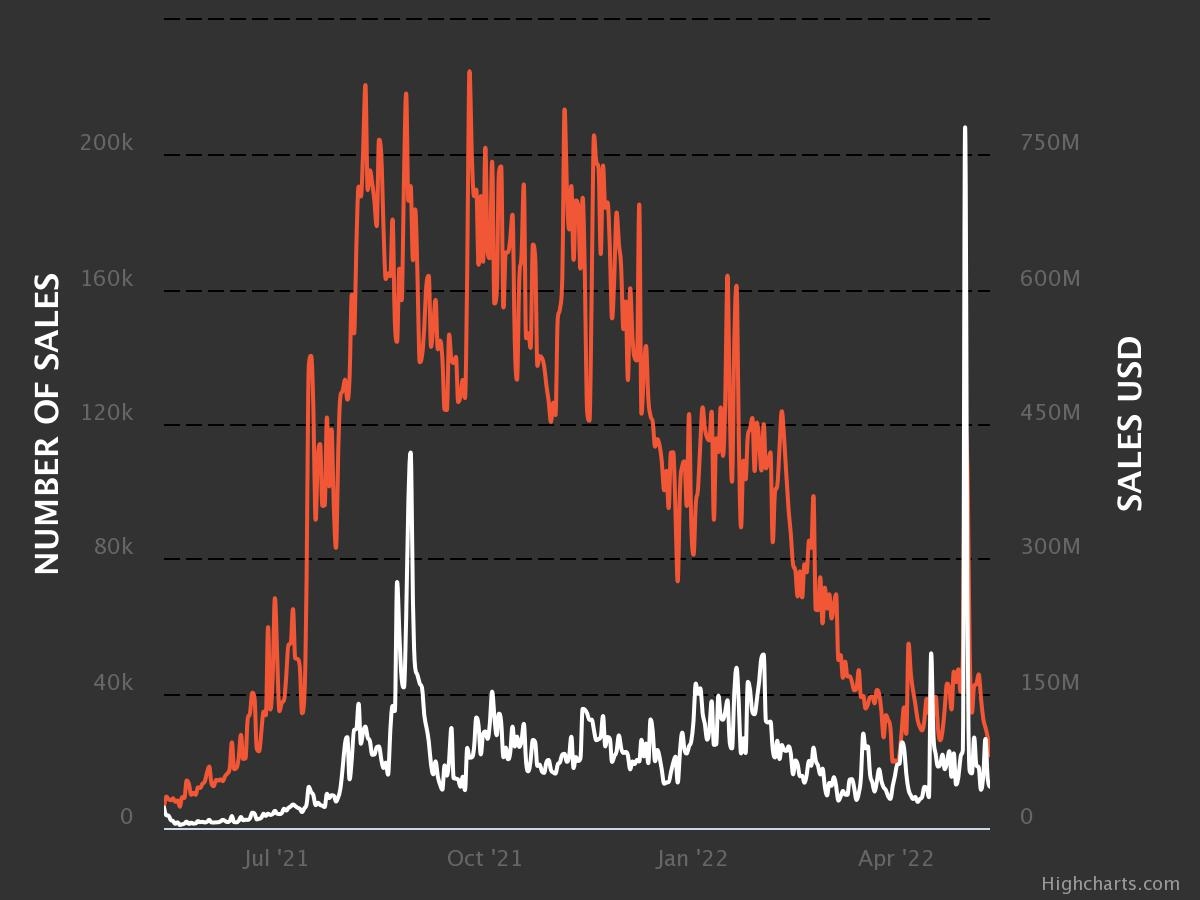

NFT volume is down as well. It's still crazy high, but I'm afraid that crypto will crash (BTC down 55% since peaks) and stocks will crash too (as many already have). Maybe time to buy Berkshire Hathaway -- Warren Buffett always knows how to make deals in a crisis

NFT trading:

Source: https://nonfungible.com/market-tracker