Contabo strange billing policy

Hello community,

I tried to get a VPS from Contabo and noticed something really strange.

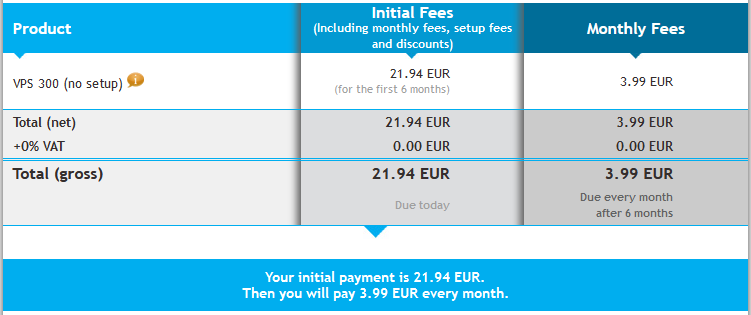

Price +0%VAT = 3.99€/month

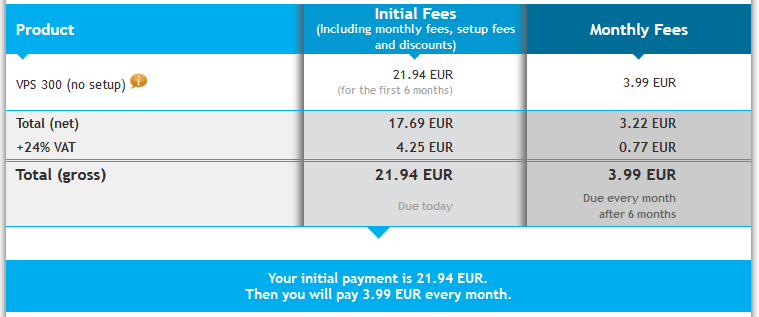

Price +24% VAT = 3.99€/month

I tried first to order using a valid VIES VAT ID and although it's showing 0% VAT the Total (gross) price remains the same (3.99)

Then I tried to order as an individual. VAT 24% was added to the price but again the Total (gross) price remains the same (3.99).

This doesn't look right. Especially if we consider Hetzner and others in EU that for VAT customer their Total (gross) price = announced price - VAT. Anyone in EU with some more experience with Contabo on this matter?

Comments

Contabo tried to apply magic and pretended it worked but they fucked up.

Free NAT KVM | Free NAT LXC

If that's on purpose, they may want to offer the same fixed price (total gross) to everybody which they achieve by adjusting the net price if VAT applies.

Whether that makes sense or not.

If you look closer at their webpage, they offer a VPS at 3.99€/month and say "this price includes VAT" - not a certain percentage of VAT. So if your VAT is 20%, the 3.99€ include 0,80€ VAT, and if your VAT is 0% the 3.99€ include 0€ VAT.

Maybe they do not want that individuals within EU (where VAT applies) have to pay a higher total price than people from outside the EU.

However, there is always some kind of unfairness as in this scenario business customers are the winners as they can deduct the VAT.

it-df.net: IT-Service David Froehlich | Individual network and hosting solutions | AS39083 | RIPE LIR services (IPv4, IPv6, ASN)

Just curious: how is this unfair? I mean, yes, sure, business customers can deduct the VAT, but they have other tax obligations.

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

If your goal is that everybody needs to pay the same amount of money for the same service.

Taking further tax obligations into account will probably to difficult, considering for instance that expenses usually reduce the taxable profit. As an individual, idling VPS' usually do not count on the annual tax declaration.

it-df.net: IT-Service David Froehlich | Individual network and hosting solutions | AS39083 | RIPE LIR services (IPv4, IPv6, ASN)

It's unusual but not utterly strange for private customers from different EU countries to pay the same net price: in this case, the provider (here, Contabo) needs to absorb the difference between the different VAT rates. (I believe that PHP-Friends have or at least had this practice.)

But it seems strange to me that an EU provider wouldn't deduct VAT for an EU business customer. If this is what you mean, it would be worth a ticket to ask Contabo about this.

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

I probably misunderstood what you wanted to say: yes, if a business customer cannot deduct VAT and pays the same end-price as a private customer, then this is unfair. (If this is what you meant.)

(I think that I didn't quite follow the formulation of your remark "there is always some kind of unfairness as in this scenario business customers are the winners as they can deduct the VAT".)

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

Talking about money, taxes and financial terms is already difficult enough in my native language; doesn't make it easier in English.

But I was actually referring to an individual paying 10€ for something from Contabo whereas a business customer paying 10€ minus (deductable) VAT, so maybe only 8€.

So in the end the same product is cheaper for the business customer than for the individual.

That's of course also a good point. From the provider's perspective it doesn't seem fair if they get less margin when somebody from a EU-country with high VAT rate purchases something.

I guess in the end it will always be unfair in some way for somebody.

it-df.net: IT-Service David Froehlich | Individual network and hosting solutions | AS39083 | RIPE LIR services (IPv4, IPv6, ASN)

So perhaps I did understand you correctly the first time after all

But isn't this the way the system works: that a business customer can deduct VAT?

In any case, @Elmo's issue seems to be a different one, namely, that he (a business customer) cannot deduct VAT (and not that he can deduct VAT).

(But perhaps I've misunderstood both @Elmo and you )

)

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

Okay, I see your point. Usually within the EU, if you can provide a valid VAT ID, you won't be invoiced VAT at all. So you do not have to pay VAT and hence you cannot deduct any VAT later (because you haven't paid it).

The unusual thing with Contabo now is that as soon as you provide a valid VAT ID, they properly invoice you zero VAT - but they also increase the net price.

If you are a German business customer (same country as Contabo), you get VAT invoiced (just like an individual) but you can then charge back the VAT from the German tax office.

So in the end you are totally right, they are disadvantaging European (non-German) business customers.

Well. Some politicians over here already tried a similiar thing when introducing road tolls (intentionally disadvantaging EU citizens outside Germany). And we all know that it didn't end well.

it-df.net: IT-Service David Froehlich | Individual network and hosting solutions | AS39083 | RIPE LIR services (IPv4, IPv6, ASN)

I'm glad that we've cleared things up

As for Contabo, it would be worth a ticket to ask them about it. In the case of a non-German EU business customer, it may be a manual change that Contabo have to make to the invoice.

But if Contabo really reduce the VAT to zero and raise the net price for a non-German EU business customer, I wonder whether this is a legal EU business practice ...

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

True, but ultimately it's the choice of the provider to do this or not. The advantage for private customers is that they all pay the same net price, independently of the VAT rate of their country of residence.

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

I don't see the taxman being happy with that approach lol

I was thinking the exact same thing. And there are lots of variations in VAT charges across the EU. It also risky for Contabo, because this would attract individuals from countries with high VAT rates, and that would mean lesser and lesser profit for Contabo.

Aye. Contacted support and here is the response:

So what we see is actually done on purpose (for some reason).

Spot on! Or actually according to Contabo's response, tax is not applied to the net price (0% VAT), but the problem is that there is no base/net price to apply tax to!! >.<. It's a variable price. I.e. if you're an individual the net price of the product is:

3.325 if you live in Austria (20% VAT)

3.192 if you live in Croatia (25% VAT)

3,218 if you live in Greece (24% VAT)

3,142 if you live in Hungary (27% VAT)

3.99 if you live outside the EU or you're an EU Business

.... and so on and so forth.

Exactly this happens with all our European providers. It's called Reverse charge on EU VAT.

I haven't seen this practice before (not even netcup do this! ). I wonder whether it's legal, but perhaps it technically is.

). I wonder whether it's legal, but perhaps it technically is.

The main disadvantage for a business customer is that a service at Contabo costs more than one initially thinks.

As I said earlier in this thread, private customers arguably benefit from this practice, and if the practice applied only to private customers, it wouldn't be an issue.

But now it's pretty clear that business customers "subsidize" the practice in the sense that the differences in VAT rates that Contabo need to absorb are "compensated" by business customers.

At the end of the day, it must nevertheless be acknowledged that Contabo have pretty attractive prices for (as far as I can tell) pretty good services, so one should probably view the practice described above as simply the cost of doing business with them.

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

True! All these won't put me off getting a VPS from them to test-drive their service

Post YABS pls

I bench YABS 24/7/365 unless it's a leap year.

In my first ~6months as a vps provider, I did the same thing. Fot that exact reason.

After ~6months I changed it to add the VAT as it was a pita doing the taxes.

In WHMCS its easy to do the change, only a checkbox. If you want to add or include the VAT.

https://clients.mrvm.net

Thank you all for your contributions. I got a VPS from Contabo to test-drive their service. It was activated within an hour and I'm testing stuff as we speak. So far everything is looking good

YABS Bench please

There you go

It's obvious that HDD speed is a PITA. But I don't mind cause for now, I won't be using lots of I/O.

IOPS seem ok for a SSDcache HDD.

Is there ISO install function? Without using their OS templates

I bench YABS 24/7/365 unless it's a leap year.

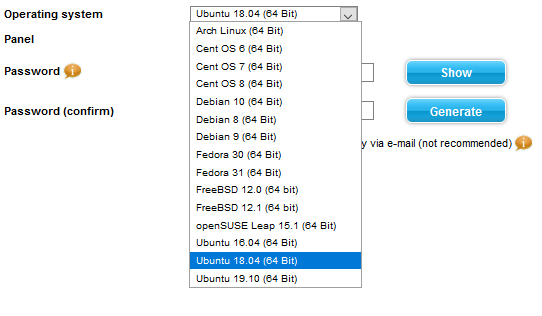

I didn't find any such option, so no. Here are your options:

Also worth noting that re-installation is not quick. One I did, took about 7min to complete.

Yes I think theres some queue system or something. Same experience with their SSD vps.

I bench YABS 24/7/365 unless it's a leap year.

I asked Contabo once about custom ISOs, and they said no. (But they can do custom installations for a price.)

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

Naturally, the scores aren't outstanding, but I would say that this VPS is a great value for money for an all-round VPS

"A single swap file or partition may be up to 128 MB in size. [...] [I]f you need 256 MB of swap, you can create two 128-MB swap partitions." (M. Welsh & L. Kaufman, Running Linux, 2e, 1996, p. 49)

Totally agree on that.